How Does Recurring Payment Processing Work?

Recurring payment processing happens in a matter of seconds.

However, it involves four steps—each of which is important to make sure payments go through smoothly.

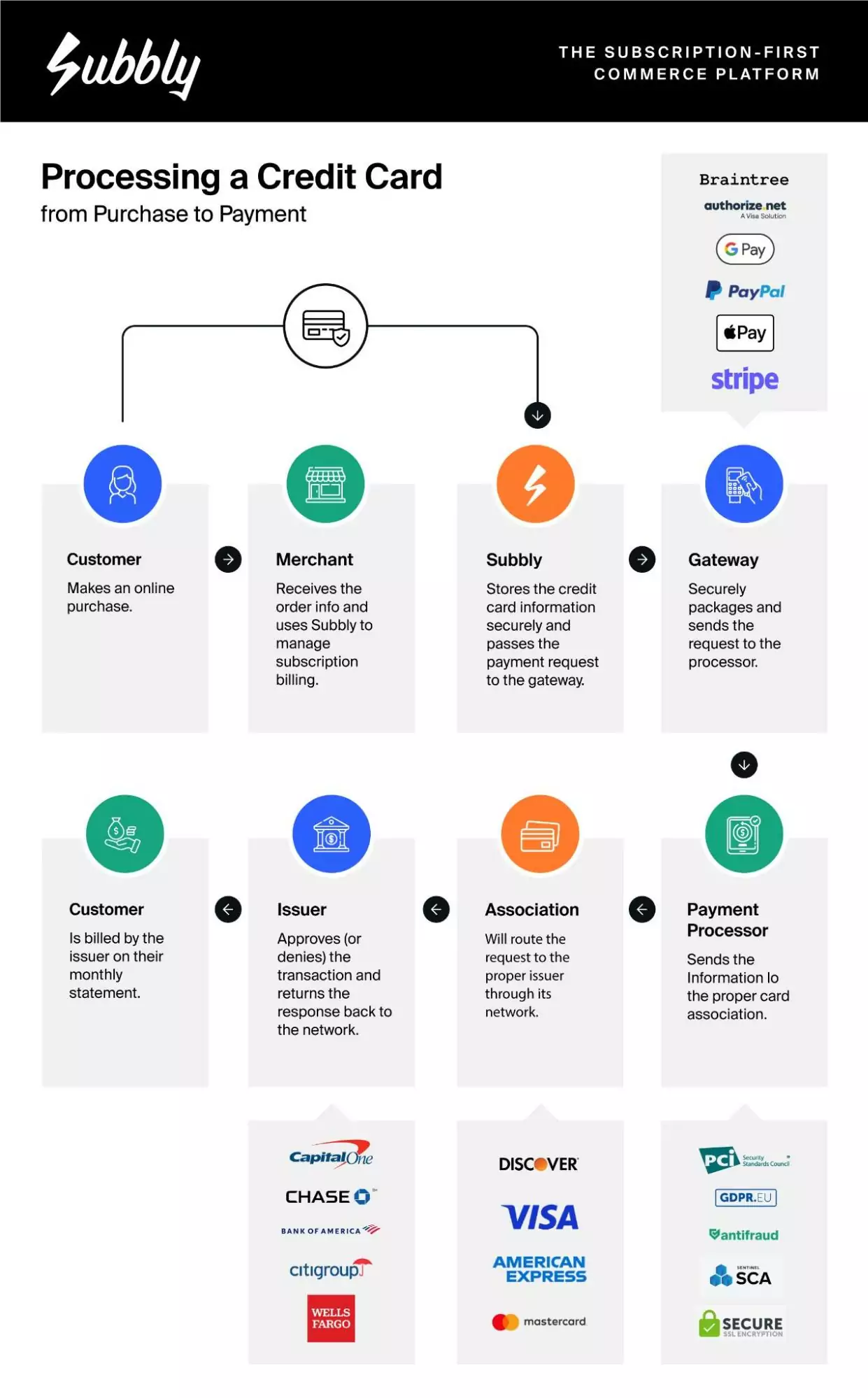

Have a look at this diagram which outlines these steps:

The best way to understand this is by following an example from start to finish:

Let’s say you run a subscription business that delivers a new bottle of whiskey or bourbon to your customers each month so that they can explore new flavors and brands.

They can easily sign up by visiting your website and choosing their preferred package, which is either one bottle once a month or three bottles every quarter.

These are the steps that kick in once they’ve hit subscribe:

🔑 Customer authorization

The journey begins when a customer decides to subscribe to your services.

Hunter, a local from Massachusetts, is intrigued by the idea of exploring different whiskies. He selects a quarterly subscription plan and provides his billing information.

This phase, known as “customer authorization,” grants your business permission to initiate recurring payments using his billing details.

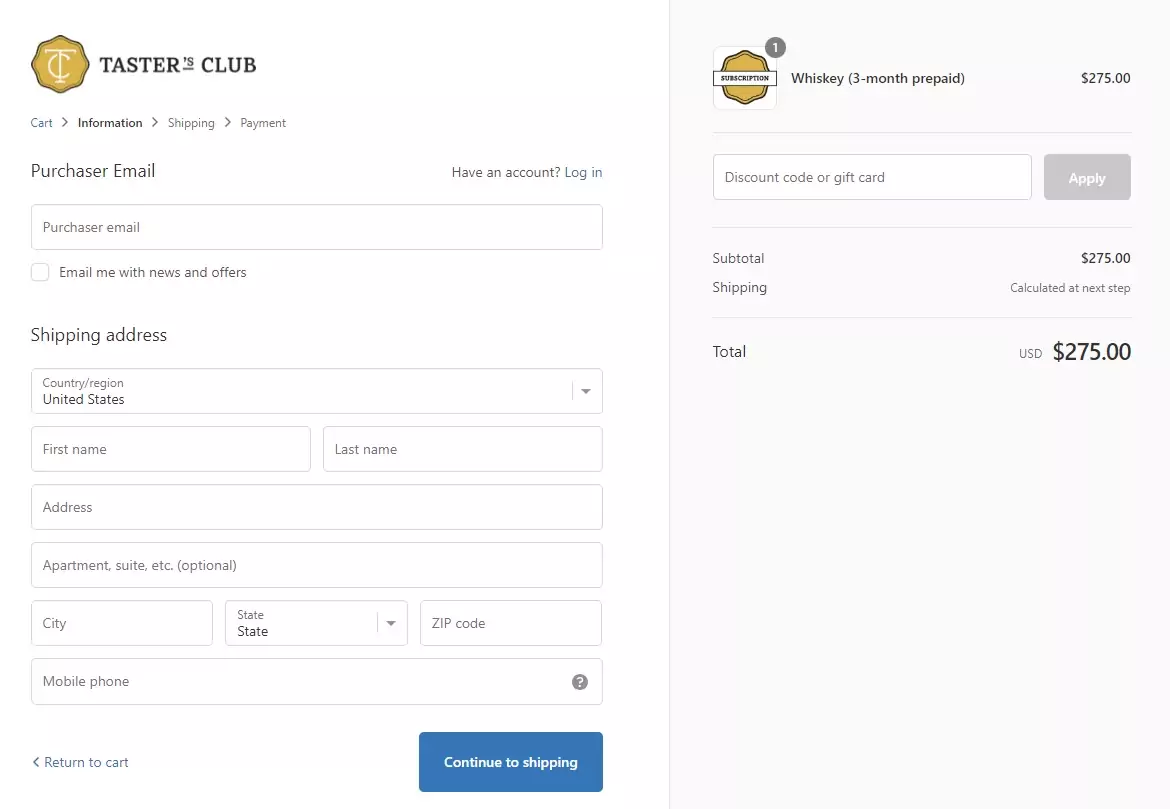

Here’s a real-life example of a form for a whiskey subscription business:

Source: Taster’s Club

💾 Payment information storage

After you’ve received Hunter’s customer authorization, his billing details and subscription preferences are encrypted and stored by your payment processing platform.

This process, which is known as payment tokenization, ensures the security of Hunter’s personal information, safeguarding it for future purchases.

You can learn more about payment tokenization here.

This information doesn’t get shared with you, the merchant, adding an extra layer of security and peace of mind for both you and your customers.

Many payment processors store this information on databases in undisclosed locations to prevent sabotage or tampering.

🗓️ Payment scheduling

With Hunter’s billing information securely stored, the payment scheduling phase begins.

Each subscription triggers a payment request, which is transmitted from your website to the payment gateway.

Here, the payment is scheduled based on the billing cycle that was selected. In Hunter’s case, a debit order will be triggered once every three months.

👍 Transaction processing and confirmation

The final step of the transaction involves the payment processor verifying the payment details and facilitating the transfer of funds from the customer’s bank account to the merchant’s bank account.

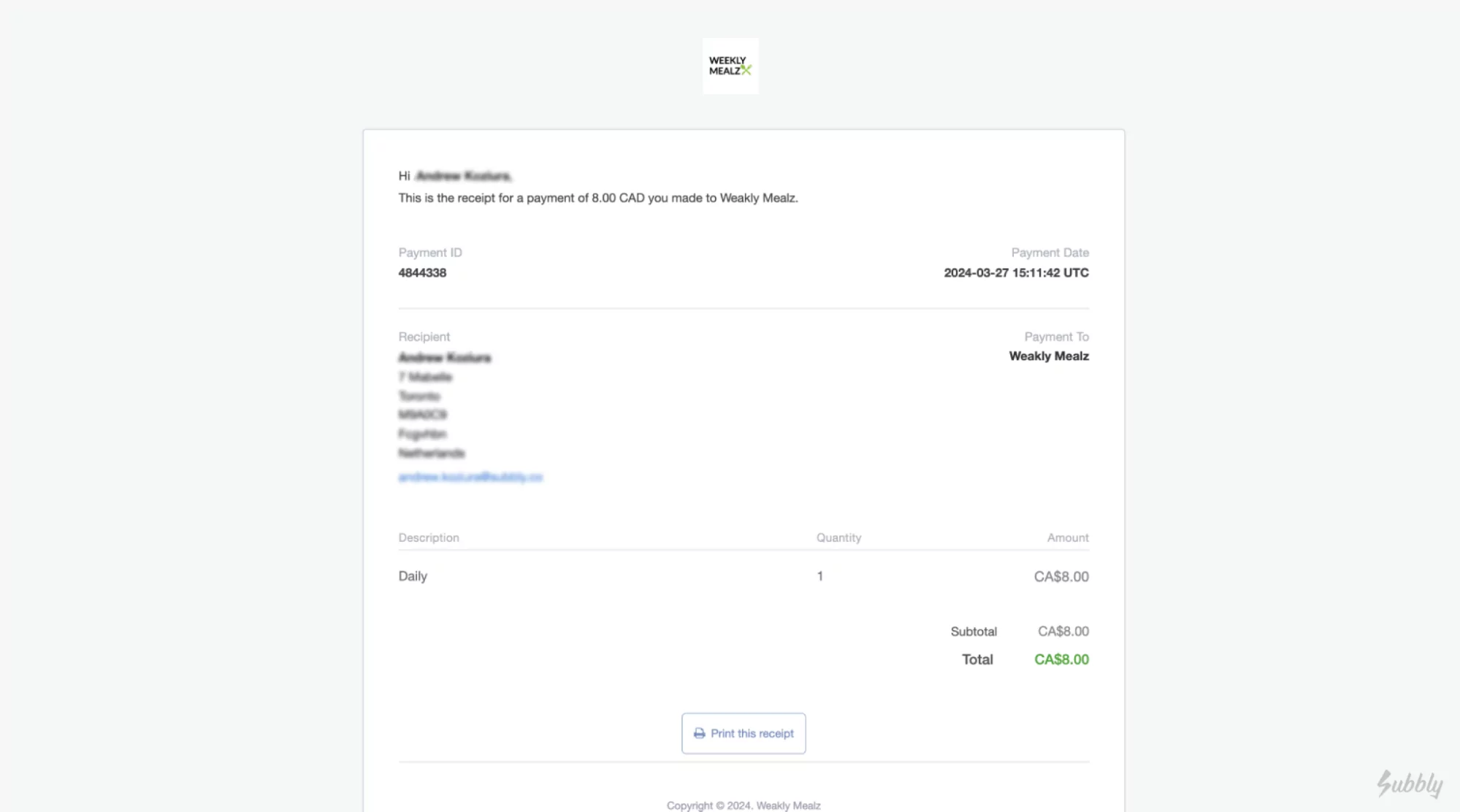

Once the transfer has happened, both you and your customer receive a notification that confirms a successful payment.

It’s the equivalent of a waiter bringing a card machine to your table in a restaurant, and after you’ve paid, you both wait for confirmation receipts to be printed before parting ways.

In our whiskey example, both you and Hunter will receive a notification confirming that the payment was successfully processed.

Here’s an example of a payment notification:

💼 Subscription management

Since you’re running a subscription business, our relationship with Hunter goes beyond the first payment.

Once the initial transaction has been successfully processed, your subscription management system takes over.

It handles various aspects of the subscription process, like sending reminders for renewals, communicating with customers, and managing accounts.

For instance, if Hunter wants to change his subscription or update his payment details, he can easily do so on your website.

When your subscriptions are managed well, your customers have a great experience, leading to long-lasting relationships and loyalty.

You can get all these benefits from Subbly, which specializes in comprehensive subscription management solutions.

With Subbly, you’ll benefit from user-friendly interfaces, customizable subscription plans, and automated billing for your subscription business.

What If the Payment Is Declined?

1. Error handling

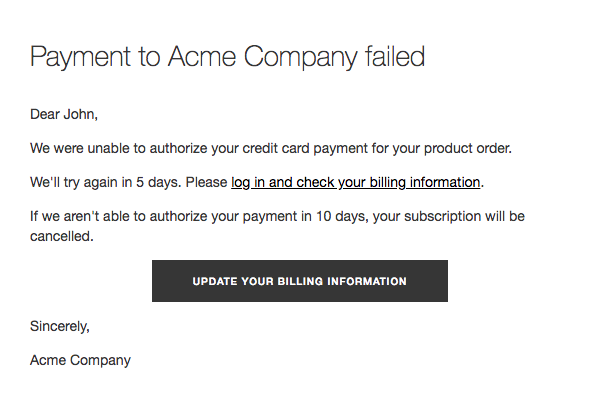

If a payment is declined, the system tries to determine why it didn’t go through.

This may involve notifying the customer of the problem and prompting them to resolve any issues.

For example, Hunter may have mistyped his bank account details when he initiated his subscription, resulting in a failed payment.

When he’s asked to review the information he typed in, he quickly realizes his mistake and corrects it.

2. Retry mechanisms

Depending on why the payment was declined, the system automatically makes a second attempt in the hopes of success.

For example, if there was a temporary network issue, trying again may have a different result. This can happen an hour later or a day later—depending on your settings.

Here’s an example of a failed payment, which prompts the customer to make corrections before their retry mechanism kicks in 5 days later:

If Hunter corrects his account details before the second attempt, then everything will be set for his payment to go through smoothly.

Going forward, Hunter’s billing cycle will continue as scheduled, with subsequent payments automatically processed in the next quarter.

🔷Want to learn more about dunning?

Read our full guide that explains the secret of an effective dunning process.

Let Subbly Do the Heavy Lifting

There’s so much that you need to take into consideration when you launch your subscription business, such as figuring out your branding and fine-tuning your product.

On top of this, you also need to make sure your recurring payment processing is handled professionally, which can sometimes feel like a full-time job.

If you want to pass on this responsibility to a trusted, subscription-first platform, then Subbly is here to assist you.

We offer specialized software that’s designed to help you manage your subscription-based services.

Among other benefits, you get access to features that aid billing, invoicing, customer management, and subscription analytics, making it so much easier to accept recurring payments.

To sweeten the deal, you can try Subbly for free before committing to it as the go-to platform for your subscription business.

Learn more about what Subbly does to see if it’s the right fit for you.

Frequently Asked Questions—Answered

Starting a subscription business requires time and effort as you learn the ropes. Recurring payments are a big part of this journey, and you might have some questions along the way.

Here are some common ones from new subscription business owners:

❓ Will my business benefit from recurring payments?

Many types of businesses benefit from subscription models where their customers sign up to accept automated recurring billing.

For example, streaming services like Netflix and Spotify have successful recurring payment models because they grant access to sought-after content.

Similarly, software companies often offer subscription-based products, like antivirus software, the success of which relies on customers regularly receiving product updates.

These businesses do well with subscription models because they offer an ongoing service that their customers are willing to pay for.

Businesses that usually sell products meant for once-off purchases can also benefit from recurring payments.

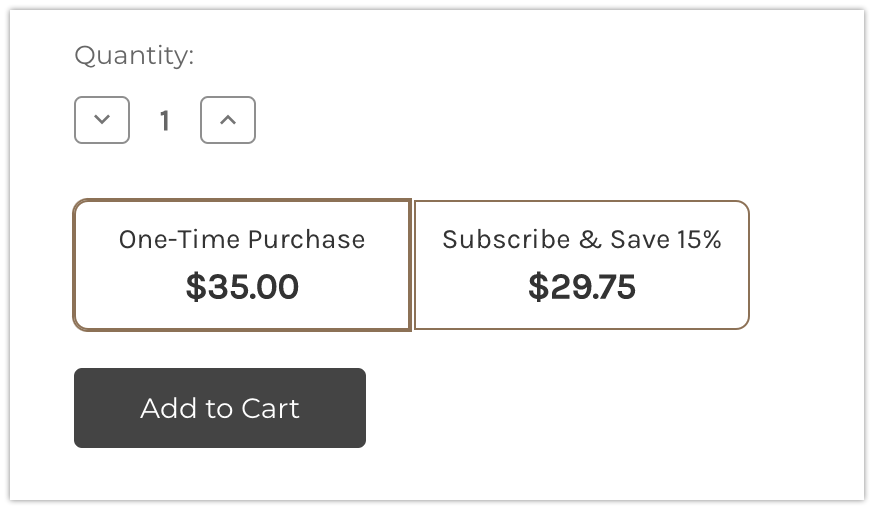

For instance, when a customer selects a product, you can give them the option to “subscribe and save 15%,” which might convince them to sign up for recurring payments.

The example below shows how this might look:

While most businesses can adopt some form of a subscription model, some businesses just aren’t the right fit, such as those with:

🛒 Low-value transactions: Businesses that sell low-cost items may not find recurring payments viable due to the cost of the transaction fees associated with each payment.

For example, a dollar store that sells inexpensive household items may not benefit from setting up recurring payments for its customers.

🎲 Irregular purchase patterns: Businesses that’s customers make purchases sporadically or irregularly may not benefit from recurring payments.

For instance, businesses that offer services that are only required on an ad-hoc basis may not have enough demand for regular payments.

🌤️ Seasonal businesses: Businesses that experience significant fluctuations in sales due to seasonal demand may not benefit from recurring payments.

For example, a company that sells holiday decorations may only experience massive sales during specific times of the year, making its product sales insignificant during off-peak seasons.

❓ Are there any legal or regulatory requirements?

There are legal and regulatory requirements to process recurring payments, particularly concerning consumer protection and financial regulations.

These may include:

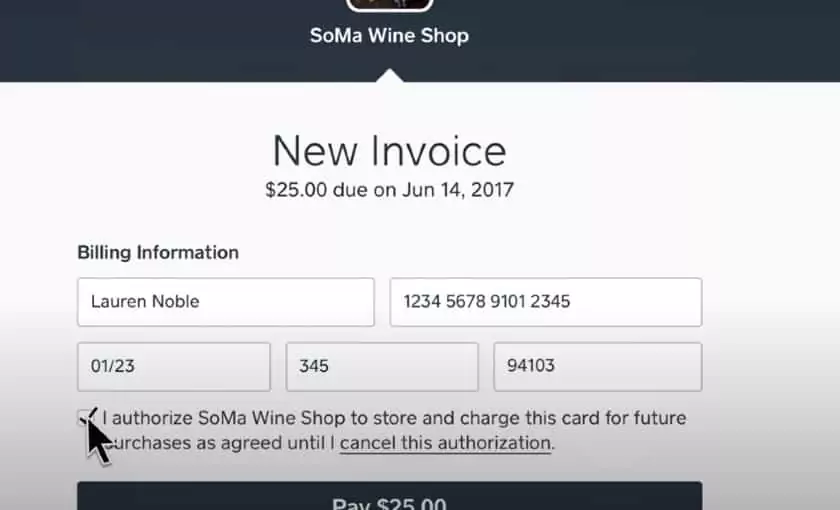

🤝 Getting consent from customers: When a new customer signs up for a subscription, you need to ensure they explicitly agree to recurring payments by ticking a box or providing affirmative consent.

This ensures that customers are aware of and consent to the ongoing charges associated with the subscription service.

Have a look at this invoice from SoMa Wine Shop—the box at the bottom gets consent from customers to charge them in the future:

🛡️ Respecting data protection laws: Depending on the region your customers are based in, you will have to comply with data protection laws.

For example, the CCPA (California Consumer Privacy Act) in California enforces data protection for customers.

You will have to commit to data security measures that:

- Safeguard customer information

- Provide transparent information about how customer data is used

- Offer ways for customers to access, modify, or delete their personal information

Failure to comply with these regulations can result in significant fines and reputational damage to your business.

💳 Complying with card payment standards: If you accept recurring payments, it has to take the PCI DSS (Payment Card Industry Data Security Standard) into account if it involves credit card payments.

PCI DSS is a set of security standards designed to protect your customers’ private card information during transactions.

📑 Following regulations set by financial authorities: This might include those of the Consumer Financial Protection Bureau (CFPB) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom.

Businesses need to understand and comply with these requirements to ensure the security and legality of their payment processes.

❓ What if I have customers outside of the U.S.?

Recurring payments work anywhere in the world. However, when dealing with international recurring payments, it’s important to consider the following factors:

💰 Currency exchange rates: When processing international recurring payments, you need to consider fluctuations in currency exchange rates.

Exchange rate variations can impact the amount you charge and, therefore, the amount your business receives.

Ask yourself the following questions:

- Will you absorb currency exchange fees, or pass them on to customers?

- Will your website display billing information in your currency or theirs?

- Will you offer lower subscription fees to customers in countries with weaker currencies so that they can afford your products?

There’s a lot to consider if you plan to include subscriptions from another country.

💼 Cross-border transaction fees: International transactions often result in additional fees imposed by banks, payment processors, or financial institutions.

These fees, known as cross-border transaction fees, vary depending on the countries involved and the payment method used.

Source: Integrated Research

🏛️ Compliance with local taxes: Every country has its own tax regulations and businesses operating within their borders need to abide by their rules.

Ensuring compliance with local tax laws, such as value-added tax (VAT) or goods and services tax (GST), is essential when offering recurring payment services internationally.

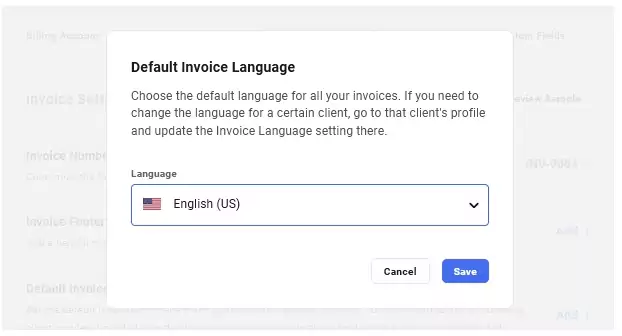

🌍 Language and localization requirements: To effectively engage with customers in different countries, you may need to provide multilingual support when presenting your payment method.

This includes offering payment options in local languages and providing customer support across different time zones.

It’s especially important that each of your customers provides informed consent to your subscription service. If any doubt could be established about the clarity of your terms and conditions, you may end up facing a prolonged legal battle.

Here’s an example of an invoice that can be generated based on a customer’s preferred language:

Source: WPMU DEV

📜 Regulatory compliance: Beyond taxes, you must also adhere to local regulations governing financial transactions and data protection.

This includes compliance with privacy laws, such as the GDPR (European Union’s General Data Protection Regulation), as well as regulations imposed by financial authorities in each jurisdiction where you operate.

Make sure you have the best recurring payment system so that you can safeguard customer data.

❓ What are the fees associated with recurring payments?

The cost of recurring payments varies depending on several factors, including:

☑️ The payment processor you choose

☑️ The volume of transactions

☑️ Any additional services or features you require

Typically, you can expect to pay fees for processing payments, which may include a flat fee per transaction or a percentage of the transaction amount.

Additionally, there may be monthly subscription fees or setup fees for using the payment processing platform.

Make sure you review the recurring payment processing fees to understand the costs involved before you get started.