Metrics are an inevitable part of doing business as they help salespeople evaluate teams’ and individual contributors’ performance. Yet, having hundreds of unstructured figures in a CRM database is overwhelming. However, there’s one crucial metric, though — monthly recurring revenue or MRR. This article will guide you through all the questions related to this particularly crucial metric — from what it is to how to increase it organically.

What is MRR?

This term stands for Monthly Recurring Revenue, or all the company’s recurring revenue normalized into a monthly amount. MRR meaning is connected with the income you generate each month. It’s a universal metric in the business world, especially among subscription companies, and a convenient way to average different pricing plans and billing periods into one consistent number that is easy to check over a certain period of time. MRR includes recurring items and excludes non-recurring ones.

This metric lets you analyze the revenue trends over time. On top of that, you can compare your MRR to the monthly sign-up rate for your service or product, monthly account growth rate, or customer retention rate. Analyzing MRR, you can see whether your revenue has been shrinking or growing over a particular period.

Why is MRR Important?

Growth rate, average sales price, and rep productivity are also important metrics. But the amount of monthly recurring revenue is the one that really matters to subscription companies. This is why:

Tracking Performance

If you’re a sales manager, MRR allows you to see how successful your accounts are. A client’s MRR can affect commission-based pay, too. Reflecting on your MRR will help you tailor your sales approach and close high-MRR deals.

Accurate Forecasting in Sales

Sales managers can evaluate the big picture and see how the team is performing as a whole. It is proven that total MRR is a guarantee of more accurate sales forecasts and projections. It helps the sales team plan for growth in both short- and long-term.

Using MRR will help you identify trends: if your MRR is growing, your business is on the rise. If it decreases, your business is struggling.

Budgeting

Running a successful business without a steady income stream is close to impossible. MRR shows exactly how much money is coming monthly. Can you hire more developers this quarter? Can you extend your marketing budget this year? The amount of revenue you’re earning is one of the critical factors in all these cases.

How do you Calculate MRR?

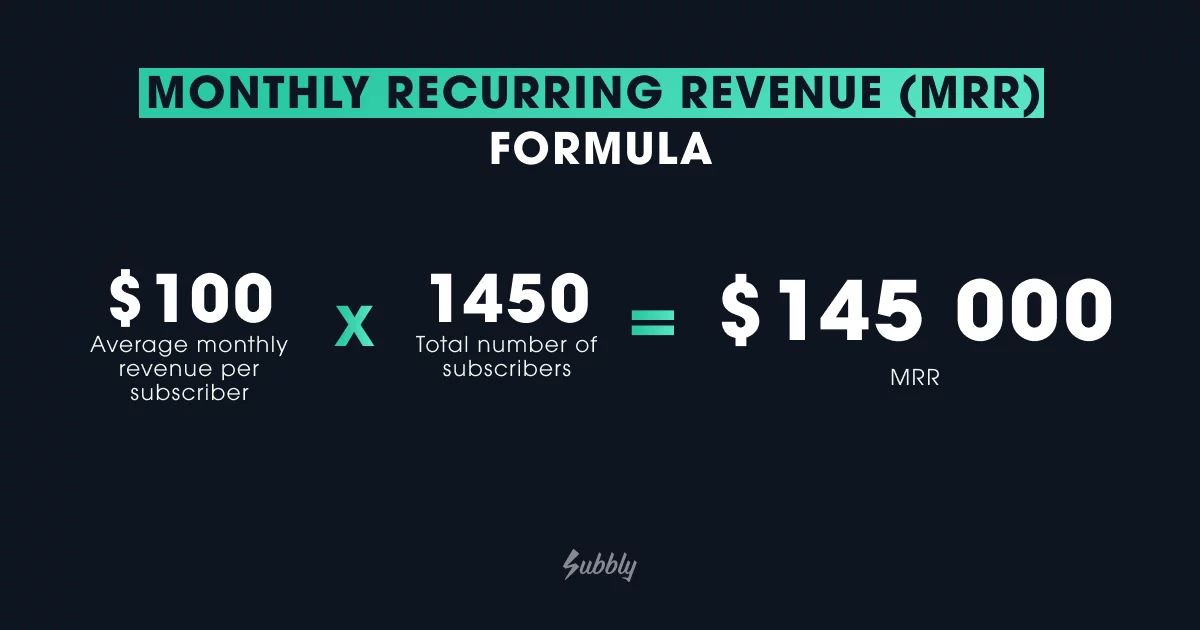

To find out your MRR, you need to know how much money you get from one customer on average (Average Revenue Per User, or ARPU) and the number of your customers or paying subscribers. Then you need to multiply those numbers:

Subscription-based businesses tend to have a mix of recurring payments and one-time charges, so it’s helpful to know what is part of the MRR count and what not. As we mentioned before, recurring payments are in, one-time charges are out:

- Included: all recurring plans & add-ons, coupon discounts.

- Excluded: setup fee, non-recurring add-ons, credit adjustments, non-recurring ad hoc charges, etc.

Here’s an example. Your customers pay $120 annually for their basic plan, so monthly revenue will be $10. Another $12 is an average recurring add-on. Other add-ons are non-recurring. Around 3,500 customers have paid subscriptions.

MRR = ($10 + $12)*3,500 = $77,000

Monthly Recurring Revenue Metrics

ARPU and the customers’ number is not the only data — there’s way more metrics and KPIs affecting your MRR directly or indirectly. Keeping track of them allows you to improve your MRR continually over time. Here are some of these metrics:

- Subscription Conversion Rate: The number of users who have signed up for a trial, either free or paid.

- Customer Acquisition Cost: How much you spend to acquire one customer.

- Customer Lifetime Value: How much on average you get from a customer over the time of your relationship.

With these metrics, you can identify the factors financially impacting your business from month to month.

5 Mistakes To Avoid When Calculating MRR

MRR is a simple metric to calculate, but it has its intricacies and edge cases that can be maddening. Here are five of them to watch out for.

Calculating Non-Monthly Payments Incorrectly

As in our example, billing can be not only monthly but quarterly or yearly. What should you do with these figures? Find the average monthly revenue.

If you bill someone $499 annually, divide this number by 12, and you’ll get $41.6 of a monthly payment. If you’re charging weekly, multiply that amount by 4.33 (there are 52 weeks in a year, so 52 divided by 12 is 4.33). Say, you charge $12 a week, then the monthly payment is $51.96. Use these two numbers— $41.6 and $51.96—when counting MRR, not $499 and $12.

Including Non-Recurring Revenue

Remember the golden rule: only recurring payments are included when counting MRR. One-time setup fees or add-ons do not belong here. If a payment doesn’t automatically recur until a customer stops the service, don’t count it in your MRR figure.

Treating MRR as an Accounting Figure

There’s no way MRR can serve an accounting purpose, as it’s strictly a business insights number. It is meant to track growth trends and show you where that revenue boost is coming from.

Including Trials

In the future, trials might turn into part of your MRR, but today they don’t belong to it even if your conversion rate is reliable and consistent. You will not help yourself or anyone else if you artificially inflate your MRR with users who might become paying customers.

Ignoring Coupons and Discounts

Let’s be honest. Do you really think you can include the full value of a $250/month customer if they currently have a 50% off coupon? The coupon might be temporary, or the customer might not buy your product at all if it weren’t for a discount. So, your actual revenue goes down, while your MRR figure ‘goes up’—but only artificially.

Now that you know what NOT to do to boost your MMR let’s take a look at how to grow it organically.

How to Increase MRR

Unfortunately, there isn’t a silver bullet for that. Months of hard work on a pixel-perfect design along with the greatest marketing campaign can sometimes barely budge your MRR graph or even show reverse growth. On the other hand, you might read big stories on Forbes about businesses with hockey stick growth that make your painfully slow progress look miserable in comparison. In fact, 99% of subscription businesses won’t have that hockey stick.

However, there are things you can do to increase MRR, and you can start putting them into practice today.

Charge More

It might sound obvious, but most companies are seriously underpricing their products. The most popular reason is being self-conscious: we are simply afraid of rejection and don’t value how much we are giving to our customers. A good example is software businesses that charge a single-digit amount for their products. Usually, their solutions help others save time or make money, so in both cases they bring value to businesses. This value must be priced accordingly, not at five dollars a month.

Another piece of advice here is to offer multi-tiered pricing options to your prospective customers. This will allow them to move up to the next level while delivering you a much-needed MRR boost.

Use Upsells and Upgrades

Customers are more likely to trust someone they interact with daily rather than those they’ve had zero interaction with. Therefore, it’s way cheaper to grow revenue from the existing customer base, rather than acquire new customers. Of course, you need to do both, but attracting new customers will always be pricier.

If your customers are growing and getting more value from your solution, you should match that with pricing. Your customers’ success is a perfect opportunity and a valid enough reason to offer an upgrade.

Upselling customers is not the only option. You can also increase prices for your new customers, offering:

- Recurring add-ons

- Additional features

- Premium support (24/7 or fast response options)

- More premium plans

Different pricing models will take you a step further to MRR growth.

Invest in Online Reviews

According to Profitero’s report, online reviews do boost conversion rates. This study found that brands with ratings between 3.5 and 4.5 stars earn more than their lower-rated competitors. Good reviews confirm the value of your offer and motivate new customers to purchase from you. People tend to trust your brand more if customers vouched for you.

Is There a Magic Wand?

The list of marketing and development tools can be painfully endless, and there’s no single solution that will propel your company to the top. Especially when it comes to subscription-based businesses. It’s all too easy to get frustrated when trying to choose the right tools to increase your MRR.

Speaking of tools, make sure to give Subbly a try. We make it easy for you to start and build your subscription business. We follow our own advice and offer you a 14-day free trial to see how we can bring value to your business. Sign up today!

Subbly – the purpose built platform for starting and growing subscription businesses