What does churn mean in a subscription context?

For the less initiated or more forgetful, here’s a quick explainer of what churn rate in the context of a subscription business.

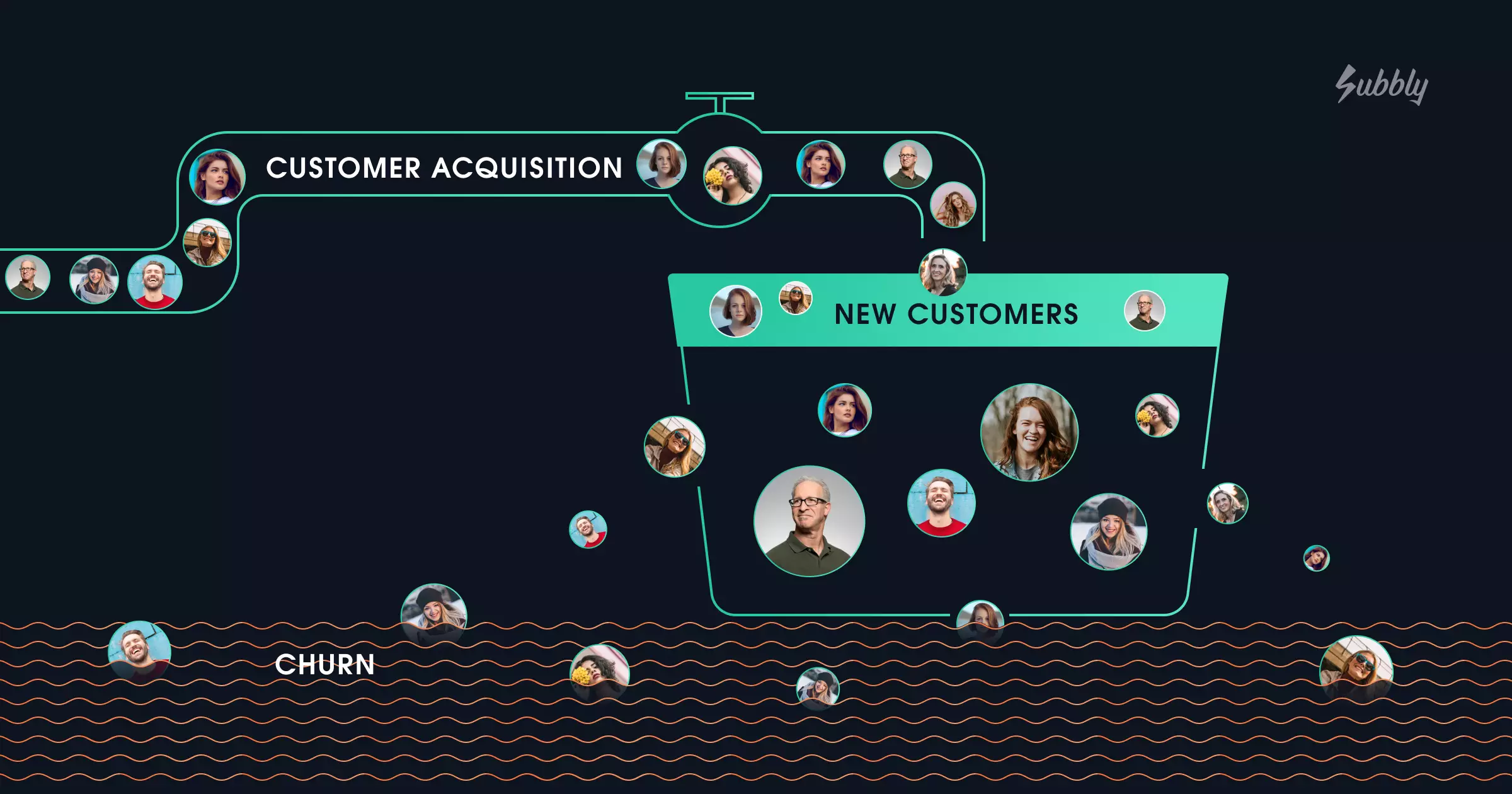

Churn is a common phenomenon in any sales-focused business, and is one of many particularly important metrics for subscription businesses.

Why is churn important?

Churn is important because it is far more sustainable, and cheaper, to retain current customers than to rely on acquiring new ones. Beyond sales figures, it also gives you a good indication of how satisfied your customers are with your products. Based on this dual bedrock you can build a successful business strategy. Returning customers equals returning sales after all.

Some aspects of churn you can control, others are more difficult. Therefore, it is important to have a plan that can both mitigate the damage caused by unpreventable churn whilst also ensuring your company is well set up to prevent, well, preventable churn. Good news then, as the secret to mitigating the damage of subscription box churn is simple to understand and implement.

Subscription churn rate - the industry average

The amount of churn you can expect to face varies according to the industry you’re working in. In SaaS, for example, the standard churn rate is almost 5%. Bear in mind, this can vary according to company size and market, among other factors.

When it comes to subscription businesses, companies selling monthly boxes, for example, have an average churn rate of almost 10%. No matter your industry, however, a good churn rate should be low — stretch yourself and target 3% or less.

Types of churn to measure

There’s several different types of churn you can measure. Your customer churn rate and revenue churn rate are good places to start to get an overview of raw numbers, but once you break it down into voluntary and involuntary churn, you’ll start to understand the ‘why’ behind what’s happening in your business, and obtain useful customer data, which you can use to generate solutions to lower the rate.

Customer vs revenue churn

The difference between customer churn and revenue churn is quite straightforward.

Customer churn is a measurement of the number of subscribers that cancel in a given time period, regardless of how much revenue each one brings in.

Revenue churn, on the other hand, measures how much revenue you’ve lost in a given time period from an existing customer base.

Unlike customer churn, which looks at all subscribers as an aggregate, with revenue churn, you’re analyzing revenue generated by a specific cohort of customers.

For example, you might notice that there’s less people taking you up on an upsell opportunity you’ve been offering as part of your marketing strategy for a while, or more customers downgrading to a lower tier.

This might indicate that the level of value they perceive from those two specific revenue-generating opportunities has decreased, and you might need to adjust them accordingly.

Voluntary vs involuntary churn

Voluntary and involuntary churn, on the other hand, can tell you a lot about the reasoning behind customers’ decision to leave. The question as to what their reason for canceling was — if there was one at all — is the main idea here.

Voluntary churn, sometimes referred to as ‘active churn’, occurs when a customer actively decides (i.e. voluntarily) to end their subscription. Conversely, involuntary churn occurs when customers’ subscriptions end with no active input on their part.

More often than not, voluntary churn is addressed proactively through finding out why subscribers are choosing to leave and working to address their concerns, whether it’s about communication, your offering, or your customer journey.

Involuntary churn is addressed differently. A common case of involuntary churn would be when a subscriber’s credit card declines and their subscription comes to an end. Often, the best way to deal with involuntary churn is to improve your dunning process (the process for obtaining late/declined payments owed to your company) both from a technical standpoint (i.e. the rules in your backend) and in a customer-facing context, such as through improved communication.

Churn analysis for subscription businesses

Understanding how many customers are leaving can help you tweak and optimize your offering over time. It’s not only important to be able to calculate churn, though, it’s also important to be able to understand its impact.

How can subscription businesses calculate churn?

Customer and revenue churn rates can be calculated with these simple equations, shown in the examples below.

How to calculate your customer churn rate

Customer churn rate: 120 (total cancellations during given period) / 1,200 (number of subscribers at beginning of period) x 100 (percentage conversion) = 10% (customer churn rate for given period)

How to calculate your revenue churn rate

Revenue churn rate: $2,400 (revenue decrease in premium subscriptions in given period) / $12,000 (maximum total revenue from premium subscriptions) x 100 (percentage conversion) = 20% (revenue churn rate for given period)

Understanding the impact of the factors that drive churn

There are several reasons why someone might decide to drop your product, indeed they might appear as myriad as the multitude of companies operating today. However, they usually come down to the following causes;

Finances

A customer may discontinue their subscription as they simply do not have enough money to do so, or a force majeure type event has occurred preventing them from continuing their subscription.

Lack of perceived quality

For whatever reason the customer decides that they don’t need your product anymore, or that it is of lower or diminished quality. They may also be oversubscribed and possess too much of a given product.

Emotional triggers

The customer may feel aggrieved or disappointed by poor customer service, perceived greediness due to price changes or increases, or they may have failed to receive the product entirely.

How to reduce churn as a subscription-based business

A high churn rate is not good – it can really hurt your business in the long term. Rising churn rates should be dealt with the minute you notice them creeping up.

It might sound simplistic but listening to customer feedback and acting on it will ensure that you can significantly decrease your churn rate.

4 tips to reduce your churn rate

- Offer a customer who’s considering canceling a change to their subscription model a discount, or some other financial incentive.

- Offer your customers special deals – you don’t have to wait until they cancel! If they express dissatisfaction beforehand, act then to prevent churn.

- Set up customer surveys that you can send out during normal interactions or when they are in the process of cancelling. Use their feedback to bolster your churn prevention efforts.

- Reach out to former customers via email or social media and offer them new deals or discounts. The communication process need not end at cancellation.

Churn may still occur but you will find that if you put our tips into practice you will likely experience it to a far lower degree than before. Welcome constructive criticism and embrace negative feedback. You will find that adopting this kind of low ego mindset will have tremendous rewards, not just regarding churn, but in all areas of your business too.

Final words

Although it may seem like a big task, it’s important to keep an eye on your churn as early as possible to make sure you can nip it in the bud before it snowballs into a major problem affecting the long-term prospects of your business.

If you have any experiences with churn and want to share them with the Subbly community we would love to hear from you. Perhaps you were experiencing a lot of churn and were able to turn the issue around, or maybe you are experiencing churn trouble right now? Get in touch, share your experiences with us, and in the meantime, rock on.

Register now to start your 14-day free trial and see how Subbly’s subscription management platform can help reduce your business’ churn rate!

Start for free today