What Is Subscription Billing?

Subscription billing is a payment model in which customers are charged at regular intervals for access to ongoing products or services.

Every time you get a new customer, they need to indicate which subscription plan interests them and provide payment information to initiate their purchase.

Customers can either choose to make manual payments at the end of each billing period, or opt for automatic debit orders by providing their billing details during signup.

Managing subscription billing includes various tasks, such as:

✅ Onboarding new subscribers

✅ Modifying existing subscriptions

✅ Handling billing inquiries

✅ Monitoring subscription performance

✅ Renewing expiring subscriptions

✅ Upgrading or downgrading subscription plans

✅ Managing cancellations and refunds

✅ Implementing promotional offers or discounts

If your business handles recurring billing effectively, you’ll keep new subscribers happy and maintain a steady profit for your business.

Good subscription billing means customers get what they pay for without interruptions. It also builds trust and loyalty, so customers stay for the long haul.

Core Components of Subscription Billing Models

Subscription billing systems are complicated because they need to account for so many different factors.

Let’s say you have a subscription business, called VegGo, specializing in weekly meal kit delivery for vegetarians who don’t have time to plan meals and go shopping.

You will need the following components to make sure everything runs smoothly:

1. Subscription management

Imagine a new customer discovers VegGo and wants to sign up for a monthly package with fresh ingredients and recipes every week.

They’ll begin by exploring your products, and what they see depends on the pricing models you choose for your business.

At VegGo, you could offer a fixed pricing model for simplicity or a tiered pricing model that caters to different preferences.

Let’s say you settle on offering three packages for customers to choose from, including:

- Starter Pack ($50/mo.): Small households, offering budget-friendly essentials.

- Family Feast ($100/mo.): Larger families or those who enjoy hosting gatherings.

- Gourmet Selection ($150/mo.): Food enthusiasts seeking premium ingredients.

This tiered pricing model accommodates different customer needs, allowing VegGo to appeal to a wider audience.

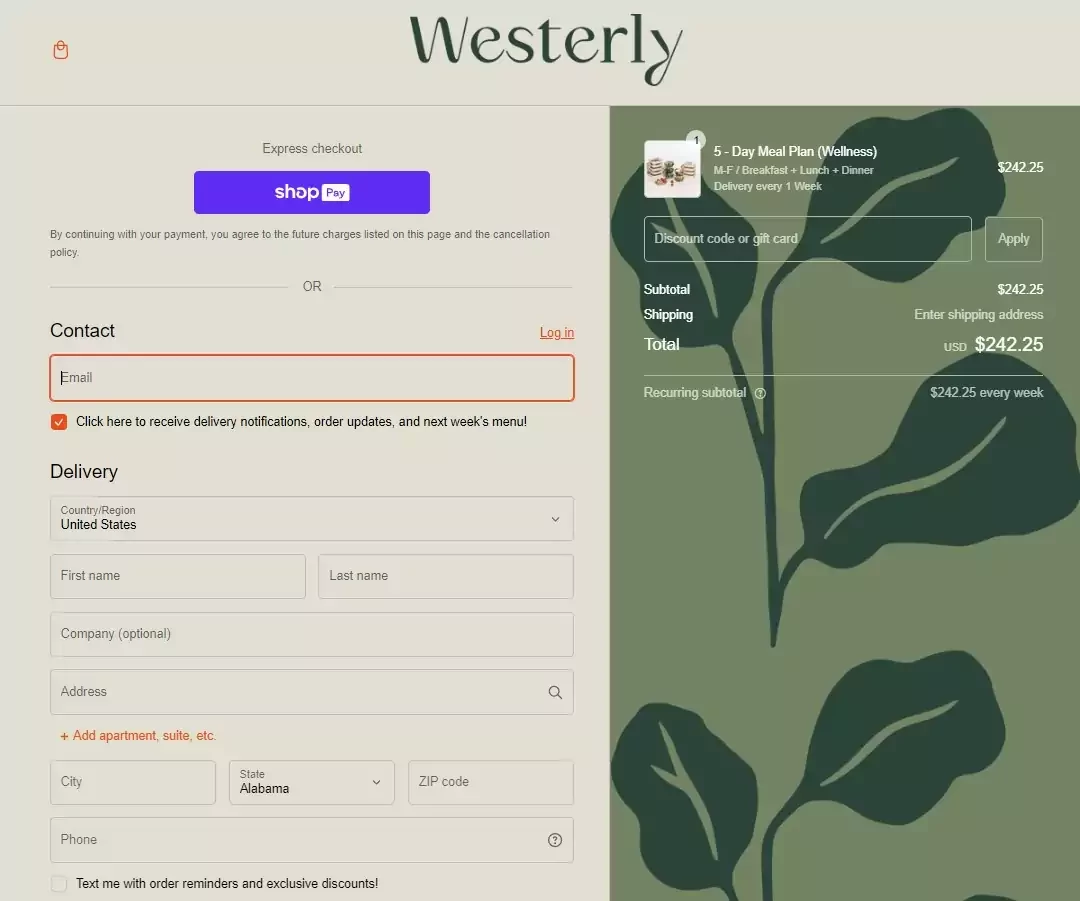

Here’s an example of a tiered meal plan from a real-life subscription business:

Next, they’d need to fill out a sign-up form, provide their details, select their subscription plan, choose a payment method and enter payment information to begin their VegGo journey.

2. Checkout process

During the checkout process, enticing offers play a big role in attracting new customers and encouraging them to try out your subscription service.

This is because they may be hesitant to follow through once they see the total cost of the subscription.

Offering discounts, free trials, or other incentives at this stage can help lessen their concerns and make the decision to subscribe more appealing.

For example, VegGo might offer a 10% discount for first-time subscribers so that they feel more inclined to sign up at a reduced cost.

Here’s an example of a pop-up that offers the same discount as VegGo:

Some other enticing offers that you typically find in subscription businesses include:

🎁 “Refer a friend” discounts: Encouraging existing customers to refer friends or family members in exchange for a discount on their own subscription.

🎁 Limited-time promotions: Offering special discounts or perks during holidays or seasonal events to incentivize sign-ups.

🎁 Bundle deals: Providing discounts for customers who choose to subscribe to multiple services or products offered by your business.

🎁 Loyalty rewards: Rewarding loyal customers with exclusive discounts, freebies, or access to premium content based on their subscription tenure or purchase history.

🎁 Freemium models: Offering basic services or features for free while charging for premium upgrades or additional functionalities.

These offers serve as powerful tools to not only attract new customers, but also facilitate their decision-making process during checkout.

3. Billing logic

After checkout, your customer will encounter your subscription billing system. Here, all the magic happens behind the scenes to ensure they’re charged correctly.

Billing logic functions like a rulebook for subscription billing. It decides how charges are calculated and when billing events happen.

Here are the key things your subscription billing system should handle:

💸 Prorations: Adjusting charges for partial billing periods when customers make changes to their subscriptions.

💸 Schedule: Deciding how often customers get billed—monthly, quarterly, annually, or on a custom schedule.

💸 Discounts: Automatically applying discounts to customers’ bills based on promotions or loyalty programs.

💸 Credits: Handling credits that have been added to a customer’s account effectively for accurate subscription billing.

💸 Taxes: Adding taxes to each subscriber’s bill and meticulously ensuring your invoices comply with the law.

A good subscription billing system handles all these details, ensuring your customers are billed correctly and on time.

For example, VegGo might want to make sure that prorations are available so that clients can instantly upgrade from Family Feast to Gourmet Selection, or downgrade to Starter Pack.

Despite weekly deliveries, VegGo could, for example, opt for monthly subscription billing and adjust it for customers who qualify for the 10% discount.

4. Accounting practices

Accounting in subscription billing goes beyond billing logic—it’s about maintaining comprehensive financial records in compliance with regulations and “balancing the books” correctly.

This involves diligently tracking accounts to make sure everything is correct. There are three vital concepts to grasp here:

- 📊 Revenue recognition: This determines when revenue should be recorded based on when services are delivered and when payment is expected. For example, VegGo records revenue when it delivers meal kits to customers’ doorsteps.

- 📊 Deferred revenue: This refers to payments received in advance for services not yet provided. VegGo records these payments as liabilities until the meal kits are delivered, gradually recognizing revenue as it fulfills its obligations.

- 📊 Accounts receivable: These are amounts owed to VegGo by customers for the meal kits provided on credit. VegGo manages accounts receivable by invoicing on time and monitoring outstanding payments.

To make sure everything runs smoothly, your subscription billing service should integrate seamlessly with the accounting practices your team follows.

5. Payment collections

After completing the subscription billing calculations, the next step is payment collection.

This is equivalent to reaching out and receiving money from your customer who’s extending it to you. However, this needs to take place electronically.

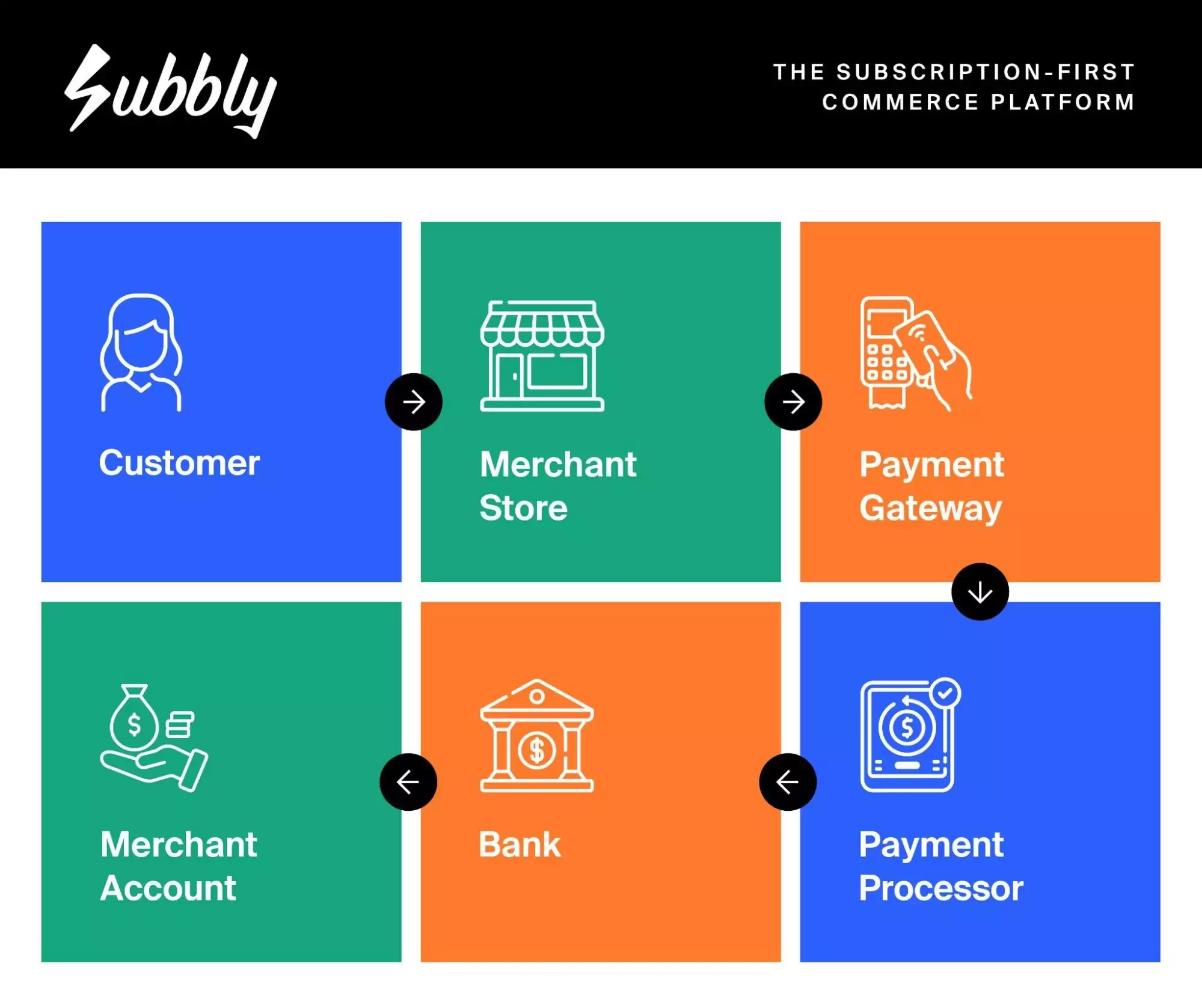

The first step is to set up a merchant account, which can be done through a payment processor like Stripe or Braintree.

Payment processors handle the transactional aspects of accepting payments, including authorization, settlement, and reporting.

Once you have set up a merchant account, you typically integrate a payment gateway into your subscription billing system.

Payment gateways serve as the bridge between your website or application and the payment processor, securely transmitting payment data during transactions.

Have a look at the diagram below to get a better understanding of how this works:

In some cases, your payment processor and payment gateway can be run by the same company—such as Stripe, which offers both payment processing and gateway services.

However, others specialize solely in one aspect. For instance, Braintree primarily operates as a payment processor, while Authorize.Net focuses on payment gateway services.

In the context of subscription billing, payment gateways enable you to automatically collect payments on a recurring basis from subscribers based on their billing schedules.

They handle tasks such as processing credit card transactions, verifying payment details, and facilitating the transfer of funds between your accounts.

During the collection phase, you may find that some customers’ payments are failing to go through due to expired credit cards, insufficient funds, or other payment issues.

You can set up a transaction recovery, or “dunning process,” to compensate for this.

This involves automatically sending payment reminders or notifications to customers with failed payments, allowing them to resolve the issue.

6. Invoicing details

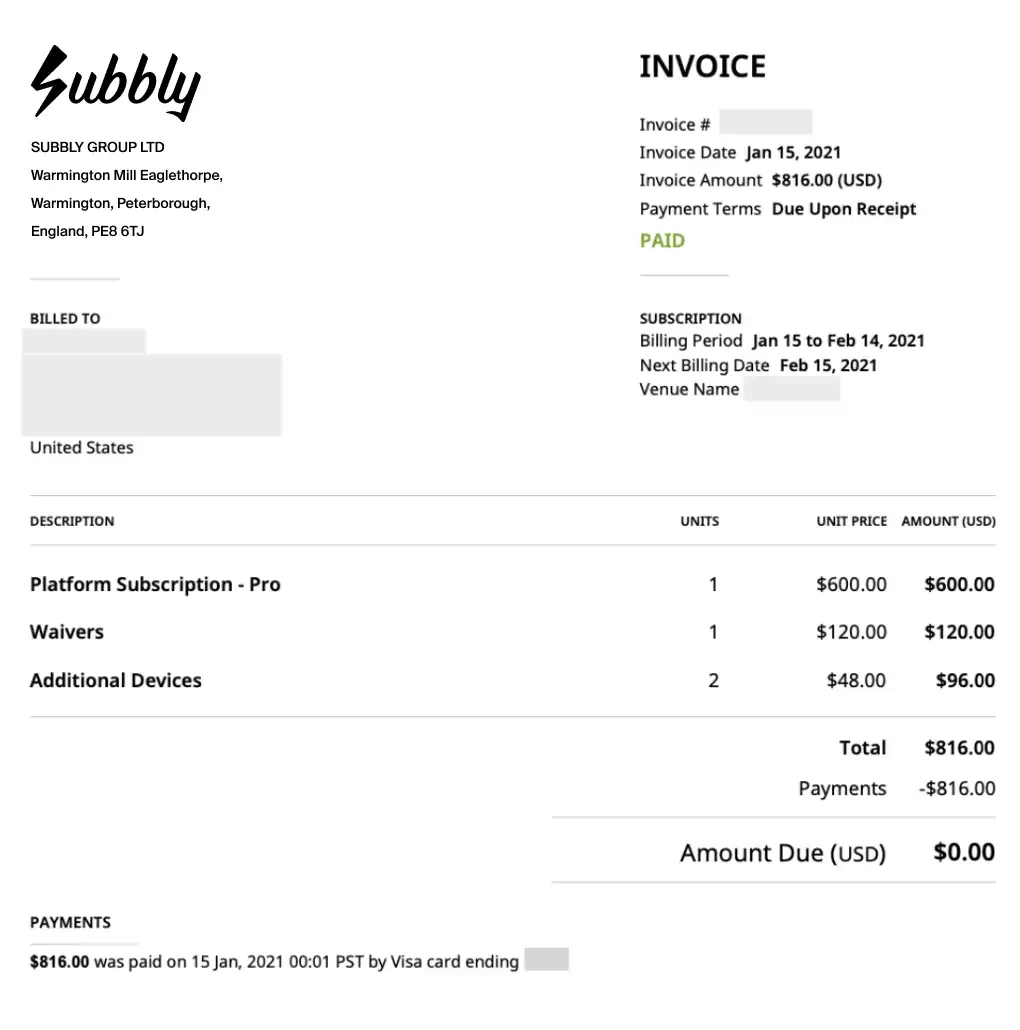

With your new customers’ billing, accounting, and collections being sorted, you can now lay this out for them on an invoice.

It should include essential details such as the customer’s name, billing address, invoice number, their chosen payment method, description of services or products, pricing, taxes, and payment due date.

This is what your subscription invoice may look like:

Additionally, the invoice should present a breakdown of the subscribed services or products, the subscription billing period covered, any applicable discounts or credits, taxes, and the total amount due.

It should include clear instructions on how to make the payment. It’s also important to provide contact information for customer support, which facilitates ease of payment and proactively caters to customer queries.

To streamline the process further, customers should have easy access to their invoices, and transactional emails can be utilized to deliver these directly to their mailboxes.

At VegGo, you could decide that invoices would be sent out at the beginning of each subscription billing cycle, ensuring timely receipt and payment processing.

7. Customer management

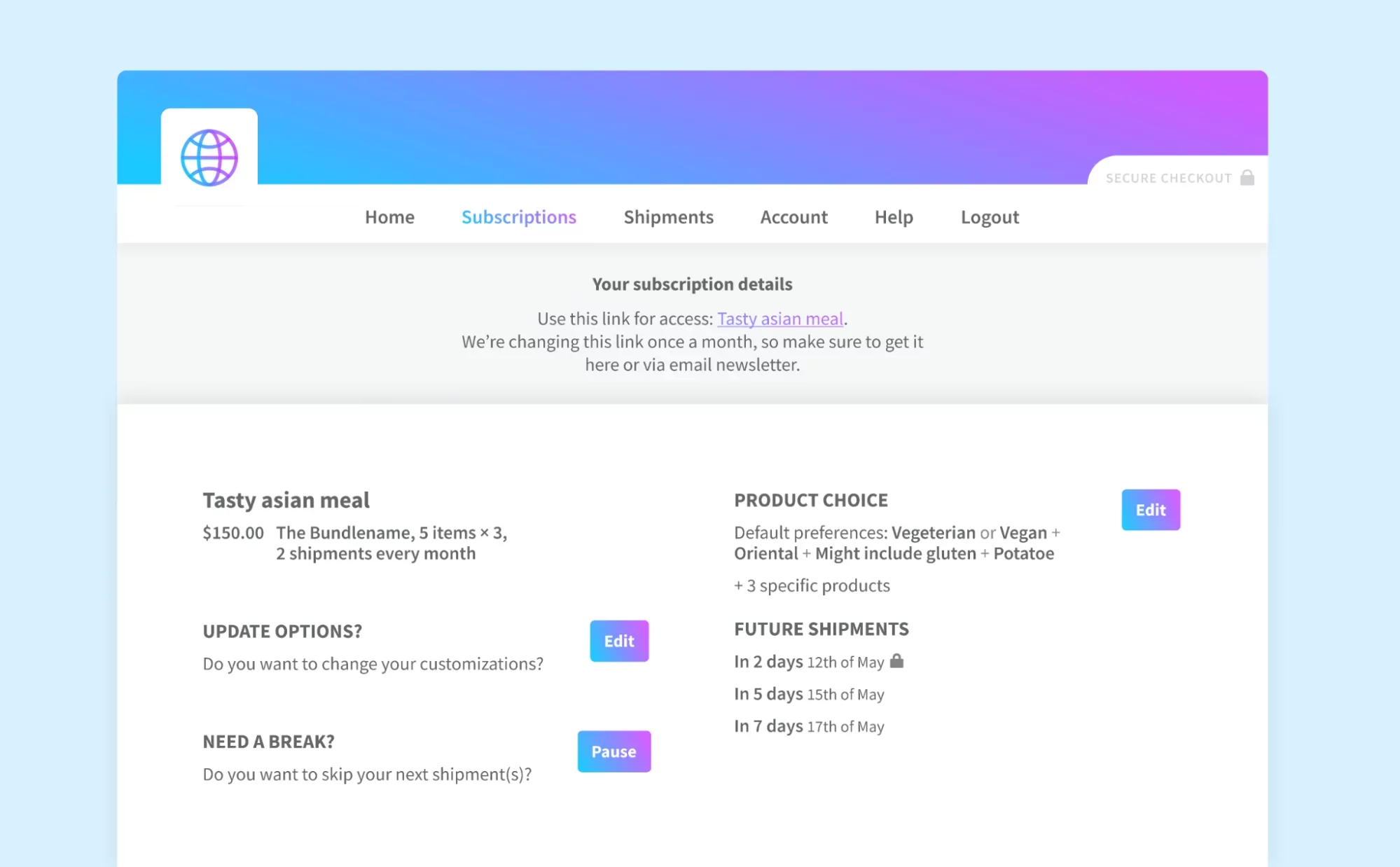

Once the transaction is completed, your customers may wish to adjust their preferences or modify their subscriptions—and this is where customer self-management comes in.

With a user-friendly customer portal, your clients can easily update their details, check past orders and recipes, and manage payments.

Here, you can see a customer portal that allows customers to view upcoming orders, manage subscriptions, and update their billing addresses:

When it comes to VegGo, customers should be able to explore different subscription packages and adjust their preferences.

This allows you to get on with your business while your customers have the flexibility and independence to change their subscriptions anytime they want.

Keep in mind that some loyal customers might still be on older, cheaper plans. Through grandfathering, they can keep their current deal even when your prices increase.

For example, if a long-time customer is on a lower-priced plan that’s been updated to a higher price, grandfathering lets them keep their old plan without sudden cost increases.

This creates a sense of loyalty and trust between VegGo and its customers.

8. Subscription billing analytics

Finally, you need to keep track of your subscription billing. It’s essential to assess what’s effective and where improvements are needed. Customers easily churn due to issues with subscription billing.

If they encounter difficulties in upgrading their service, receive inaccurate prorated bills, or fail to receive invoices required for tax purposes, you risk losing them.

When you monitor and streamline your subscription billing by incorporating all previously mentioned components into your system, you can swiftly address any pain points in your subscription billing process.

You need to pay special attention to the following metrics:

📈 Churn rate: The percentage of customers who cancel their subscriptions within a given period.

📈 Average revenue per user: The average amount of revenue generated per subscriber over a specific period.

📈 Customer lifetime value: The total revenue a customer is expected to generate throughout their entire relationship with your business.

Let’s say VegGo realizes from its reports that the churn rate has increased significantly over the past month.

This observation results in VegGo determining that many customers churned due to issues related to subscription billing, such as not receiving invoices on time or noticing inaccuracies in their prorated bills.

In response, VegGo decides to streamline its subscription billing process, improve communication regarding invoices, and ensure accuracy in billing calculations to reduce churn and enhance customer satisfaction.

How to Set Up Recurring Payments for Your Business

If you’ve made up your mind about starting your own subscription business, then you need to decide how you’re going to run it.

One of the core parts of your business that could set it miles apart from your competitors is an effective subscription billing model.

Therefore, this should be one of your main focus areas when choosing how to set up your business and deciding how you will manage it.

Overall, you have three options:

1. In-house or outsourced development

You can hire a team of software developers to build a website and subscription billing solution from scratch.

While this approach offers maximum control and customization, it requires significant time, resources, and expertise.

However, this route also involves ongoing expenses for developer salaries, which can be costly in the long run.

2. E-commerce platforms with subscription plugins

You can get a subscription plugin for an existing platform, such as WordPress, Shopify, or WooCommerce.

This is often cost-effective, but it may require several plugins to function, leading to increased complexity in managing your online store—as well as added costs.

You may also need to combine multiple plugins to achieve all the necessary functionality, which could lead to compatibility issues.

3. Subscription billing software

Lastly, you can choose a platform that dedicates itself to subscription business models.

These platforms offer ready-made solutions with features like automated recurring payments, subscription management, and flexible billing options.

They easily integrate with your accounting systems and often include support and updates.

A subscription billing platform provides you with a comprehensive solution that’s specifically designed to manage subscription businesses.

If you choose good subscription billing software solution, it will take care of all the components we covered in the previous sections, including:

🚀 Customer management

🚀 Plan configuration

🚀 Automated subscription billing

🚀 Proration and adjustments

🚀 Invoice management

🚀 Reporting and analytics

🚀 Integration and scalability

Subscription billing solutions simplify the entire billing process, and it ensures that businesses can offer a better customer experience.

Why Use Subbly?

With Subbly, you can streamline your subscription management process and focus on delivering exceptional service to your customers.

Instead of setting up a solution with numerous plugins or allocating a large chunk of your budget (or worse, relying on a hefty loan) to pay for software developers, you can use an all-inclusive, subscription-first platform.

We pride ourselves on focusing all our attention on providing robust features and user-friendly interfaces tailored specifically to subscription businesses.

Whether you’re a startup or an established enterprise, Subbly offers scalability, flexibility, and reliability to meet your subscription billing needs.

Try our free calculator to see how much you might save by choosing Subbly over an alternative subscription billing option.

Fun fact: We predict you could save over $500,000 in five years using Subbly!

You can get started for free today!